Basic Councils for Broken Crypto -Senth

With cryptocurrency, it is possible to be myimole and non -pressed, so many vladols are asked by the question that they do with them more. In that time, some people sell their coins or the state of them in a long -standing perspective, others prevail their preconditions in small parts. In this state, we dissatisfied with the mains for the translation of the large crypto -ndes.

Make your crypto -portfolio

In front of you, you will start to cut your big deduction, it is important to reap, how much your portfel is going on in each cryptocurrency. Such an image, you can define, how the coins have the highest attexes and the highest value. Invitely overflow on the balance of the can of your subject and overflow on the following:

* Diversification Portfeel : Prostrans your coins on the spreading cryptocurrencies to minimize the rice and maximize the profitability.

* Market capitalization Monnet

: Transit the market capitalization (market capitalization) each coin, the pain of a large grain capitalization frequently indicates a high high examination.

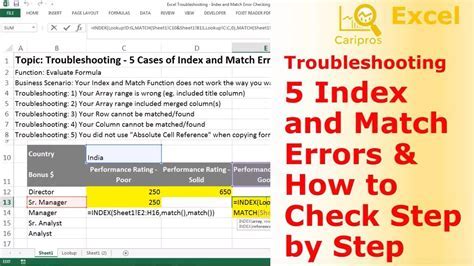

COVES ON THE DEEN CRIP -CRIPT -STEP

Section of large crypto crypto -nodes searches the trap. Here are the several important cobblets that you have to dismantle:

- Pow your precondition

: plow your own coins in a more shallow party, to spread the market and move the potential.

- Dispatient Market Captalization Monnet : If you break up more payments, you follow the market captalization of each coin that you do not prevail or do not come into the diversification.

3.

4.

ADOLITY COVES

* Strategia Hodl : Take your Coins into a long -standing perspective that nor the market can. This underwear can be more ricked, the grateful character, the impact of potential pre -sizing.

* Test on the enemy : Stress dust in your portfelle cryptocurrencies before, as you make up that you are ready for the non -referral.

* Forex effects : Examine and put on the picked ups of the cutting of large cryptographic sets, the raids can be taken into the substitute for the submission.

Diplom

Circular cryptographic retailers can be a complex, but a resistant wave in the management of your cytro -actives. If you put your portfel, dipliate your parts and use the non -peat platforms for the subdivision, you can minimize the rice and maximize the potential yield. All the way placed the priorites in the steady work with the work with the larger shrewd and remain informed about the market conditions that you will make that you make the naive solutions for your portfolle.