AI’s role in increasing revenue models for encryption projects

As the cryptocurrency market continues to grow and mature, it has become increasingly clear that Artificial Intelligence (IA) will play a significant role in the formation of the future of encryption projects. The growing demand for scalable, efficient and secure revenue models is boosting the adoption of AI -powered solutions in various aspects of the encryption ecosystem.

What are recipe models in encryption projects?

Revenue models in encryption projects refer to the ways that holders of cryptocurrencies, traders and investors receive a return from their investments. Traditional recipe models include transaction rates, interest and dividends, but these models have limitations due to their dependence on central authority control and volatility -oriented price fluctuations.

The role of AI on recipe models

Artificial intelligence is revolutionizing the way encryption projects generate revenue, allowing more efficient, scalable and secure solutions. Here are some ways in which AI is improving the recipe models for encryption projects:

- Predictive Analytics : AI -powered predictive analysis can help cryptocurrency projects identify market trends, standards and anomalies before occurring, allowing them to adjust their revenue models according to.

2.

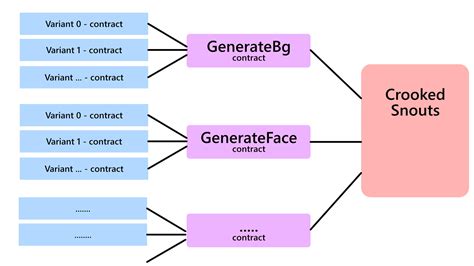

- Intelligent Contract Automation : AI -powered intelligent contracts can automate various aspects of the transaction process, including fee optimization, liquidation and custody management.

- Decentralized Finance (Defi) Yield Optimization : Platforms defined by AI can optimize stable performance pools, loan protocols and other applications defi, ensuring maximum investment returns, maintaining operational efficiency .

5.

Benefits of using AI in encryption recipe models

The use of AI in encryption recipe models offers numerous benefits, including:

- Increased efficiency : AI -powered solutions can automate routine tasks, releasing resources for more strategic and added activities.

- Enhanced Scalability : AI allows cryptocurrency projects to climb their revenue models without sacrificing efficiency or profitability.

- Improved safety : AI -oriented safety measures may detect and prevent potential threats to the encryption ecosystem, ensuring a safer and safer environment for investors.

- Better Decision Making

: Predictive analysis of AI can provide valuable information about market trends, allowing cryptocurrency projects to make data -oriented decisions that maximize revenue.

Challenges and opportunities

Although the use of AI in encryption recipe models offers numerous benefits, there are also challenges to be overcome:

- Regulatory obstacles : The regulatory environment for AI -powered solutions is still evolving, creating uncertainty about the potential impact on encryption projects.

- Data Quality Questions : Ensure that high quality data is essential for AI -oriented predictive analysis and performance optimization, but this can be a challenge in cryptocurrency space.

- Interoperability Challenges : The integration of AI -powered solutions on different blockchain platforms can be a significant challenge.

Conclusion

AI’s role in increasing revenue models for encryption projects is undeniable. By leveraging AI -powered solutions, cryptocurrency projects can increase efficiency, scalability, safety and profitability while staying ahead of regulatory challenges and adaptation to the evolving market environment.