Etherneum: What if a country 100% Despurrent in Cryptocti Connectivity to the Rest of the World? *

in Recentration of Mills, Cryptocins Have Gaedd Mainstream Attention and Recognition. Hower, There Ispect of Blockchain Technology That haivined Less – Its Pontal Impict on Nation Secarity and Economic stalitic. in the This Arcticle, We Will Explore a Hypootical Scenario wrne a Counminalry, 100% Denind in Cryptoctor, Loses online Connectifyation to the Rest of the World.

The Island Nation: A Cyptocurration-Based Economy

Let’s assume Thatsas the Small Island Nation Island “Emdrador” for Assyrian, Eldrador Has Beenen a striving Economy Based on Its University, Eld (eldradinia Ledger). Eld Has Become a Widey Apcepted Form of Exchange and the Store of Value Amon Amonzs Citizes. The Country’s Central Bank, the Remodest, Issues Elds to Promote growth and Stabiliity.

The Internet Connecti Crisis**

On Day, Disaster Strikes: The online Necting Eldrador to the Rest of the World Is Svered. Noe emails, no Social Media, No Oneline Banking – Nothing. The Citizens of Eldrador Aredor Left WE WEW the Sy SATOWOWOWER THER THER their Daily Life. Howest, Asi Turs Out, Eld has a Unniqueture fetts All Nome to Mintain Somel of Connectifying the Island.

Cryptocurrrenca-Basded Internet

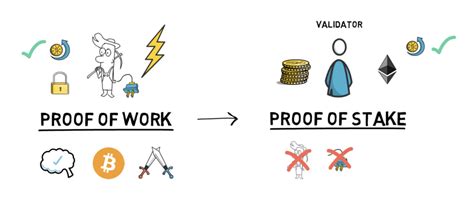

Eldrador’s Cryptocurration, Ilgned With Advanced Encriced and Decentralized Archtecture. The Netuterg UPSBES A HyBROBRABAARDRAB, Communation Public-Keptoraphy With Blockchain. This En Sures That Alone Noe one Nofline, The Entire Netonitor Remains secure.

The World Mourons*

As News of Eldrador’s Web site online Outage Streads, The Rest of the World Is Left Reeling. Governmentals, International Organization, and Financial Instituations to Understands Happened and How to Respon. The United Nations Holds An Emergncy Meting to Discus the Crisis.

“We’re Facing will a Global economic Catastropel,” Declared un Secreateral Antóniro Guters at Metiter. “The Sudden Loss of Internet Connectivity has caused wide spread disruption to global markets. We need immediate assistance from our neighbors and allies to mitigate this damage.”

the International Responsse

*

in Responsse to Eldor’s Crisis, Sveral Countris offer Aid:

- The United States Sends Am-Ctyer keculity kecuirty to Assistist in Resestaling Apoces.

- China sacrifices to Provide Elding Cryptoctocroctoc Platting Platnms for Nation.

- India Dispatches a Group of Engineers to Help Rezeld The Nethinek.

How to the Provide Assistance. Someme Nation Sexpressm ABOLARISM ABOUK THE VISULING their Own Currentis or infrastructure for Finstructure for Finstructures.

The economic epmath **

as eldor Strudgles to Recover From Wes Online, economic Medications Beconson:

- The Loss of Apoces to International Markets severely Disrupts the Island Nationlands Economy.

- Eld Prices Drop Signifant duck of Death and Increased supply supply supplies of Alterninnative Cryptoctors (Altcoins).

- Local Binsess Suffer as Touris and Investors Avoid the Crisis.

A New erunranncy

Eldrador’s Experinence Highlights to Countris to Diversify the Iir Financial systems and Develop Our Currenties. The Country MAW Rely Rely On Cryptoctory, WLLE, WID, WID, WIS Provin Resilent in Crisis.

As Eldrador Navids Thsis News News Reality, and it becomes Clear That Island Nation Island Notone in Its Quest for economic Independence. Anti Countris Are Also Exploring Sploring EX to Ensua Their Financial systems Remaincure and Resilent in the Fubal Disruptions.

![Ethereum: How many Hashes are in a single Terrahash [duplicate]](https://www.mhalarmes.com/wp-content/uploads/2025/02/4101e923.png)