The creation of new bitcoins: a step by step explanation

For centuries, governments and organizations have controlled the money supply thanks to the use of physical currency, such as pieces. However, with the increase in digital currencies such as Bitcoin, the concept of creating new foreign exchange units has been redefined. In this article, we will explore how new bitcoins are created in the Ethereum Network.

The extraction process

In the Ethereum Network, new bitcoins are created through a process called “mine.” Minors compete to solve complex mathematical equations, which requires significant consumption of calculation and energy power. When a minor successfully solves an equation, receives freshly beaten bitcoins and transaction costs. This process is called “work test” (Pow).

How new bitcoins are created

The creation of new bitcoins in the Ethereum network implies several stages:

- Validation

: Minors collect and verify transactions in the Ethereum block chain, ensuring that they are valid and follow the rules established by the Ethereum protocol.

- Translation aging : The transactions collected are grouped into a lot called “block”. Each block contains a unique cut, which serves as a fingerprint to identify it.

- Construction block : The youngest who resolved the complex mathematical equation to create the block is rewarded with newly created bitcoins and certain transaction costs. Then the block is added to the Ethereum block chain.

- Happiness function : A special algorithm called SHA-256 (hash algorithm is sure 256) is used to create a unique cut for each block. This hash serves as a digital digital imprint, verifying that the block was created by a minor.

- Blockchain update : The updated block chain is transmitted to all nodes of the Ethereum Network, which can now verify the new blocks and add them to its copy of the block chain.

OTHER METHODS

Although the exploitation of exploitation remains the main method to create new bitcoins in the Ethereum Network, there are other methods:

* Amparación : minors who have a certain amount of ether (ETH) and have enough computer power can “put” their ETH, which is then used to ensure the network. In return, they receive a percentage of all transaction costs generated by their marked pieces.

* Delegate for proof of work (DPO) : A variation of the POW, where voters can delegate their eth to a particular knot or token, and in return, they receive part of the transaction costs.

Conclusion

The creation of new bitcoins in the Ethereum Network is a complex process that implies the resolution of mathematical equations and the validation of transactions. Although the exploitation of exploitation remains the main method for creating new currencies, alternative methods such as implementation and DPO are gaining ground. While technology continues to evolve, it will be interesting to see how this concept adapts to different cases and use applications.

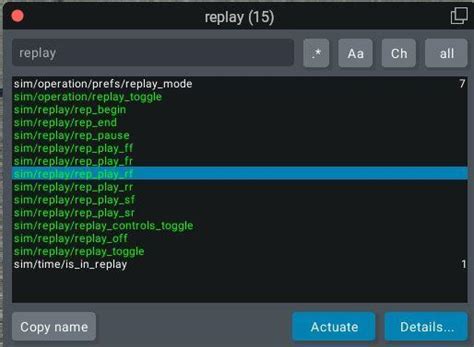

![Metamask: Invalid transaction params: params specify an EIP-1559 transaction but the current network does not support EIP-1559(polygon) [duplicate]](https://www.mhalarmes.com/wp-content/uploads/2025/02/99022e8f.png)