Ethereum: Is Tesla’s Public Wallet Address Known?

As Tesla, Inc. continues to capitalize on its Bitcoin investment through strategic purchases, the question of whether the company’s public wallet addresses are publicly accessible has sparked curiosity among enthusiasts and investors. Despite being a major player in the cryptocurrency space, details about Tesla’s wallets remain somewhat secretive.

Why the secrecy?

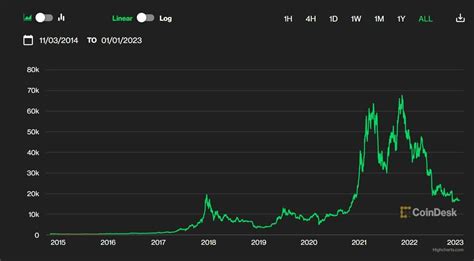

In 2017, it was reported that Tesla had acquired over $1 billion worth of Bitcoin, raising concerns about potential financial exposure for the company. To mitigate such risks, CEO Elon Musk has historically taken steps to safeguard his personal and institutional assets. One method he has employed is the use of a pseudonymous public wallet address that may not be directly linked to his real-world identity.

Is It Known?

While Tesla’s official website provides information about its Bitcoin holdings, including the amount of each cryptocurrency, the company rarely shares publicly available details about its wallet addresses or transaction history. Furthermore, when asked directly about specific addresses in previous interviews and public statements, Elon Musk has generally declined to disclose them.

What if They’re Not Known?

If Tesla’s public wallet addresses are indeed unknown, several questions arise:

- Who Owns the Assets?: If the wallets are pseudonymous, it may be difficult to determine who actually controls the assets.

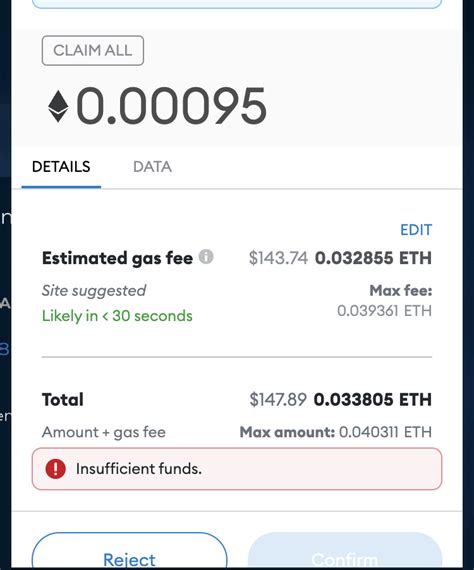

- Risks and Liabilities: As mentioned above, having significant Bitcoin holdings could expose Tesla to potential losses in the event of a market downturn or other unforeseen circumstances.

- Security and Control: Using pseudonymous addresses can make it more difficult for authorities or others to trace transactions and potentially freeze assets if necessary.

Conclusion

While the specific details of Tesla’s wallet addresses remain private, the fact that they are not publicly known suggests that the company takes steps to protect its assets from potential risks. As with any cryptocurrency investment, it is essential that investors do their own research and exercise caution when dealing with potentially volatile markets.