RETTS TRANSACTS ETHEREUM: CURNING UNISWAP UNIVERSAL ROUTER PROBLEM

As a programmer that uses Blockchain Ethereum, the Uniswap universal router (UR) probably knows. This powerful tool allows a safe and safe tokens replacement on the Ethereum network. However, when it comes to transactions, problems may arise. In this article, we will examine why your transactions are returned and provide a step by step to purify and solve these problems.

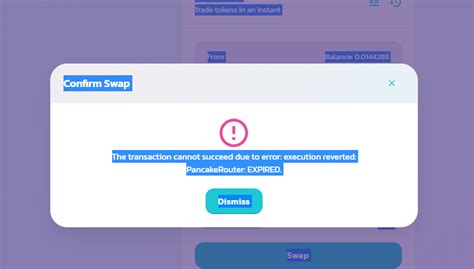

Why are transactions withdrawn?

Before immersing ourselves in the solution, we understand why transactions can be returned:

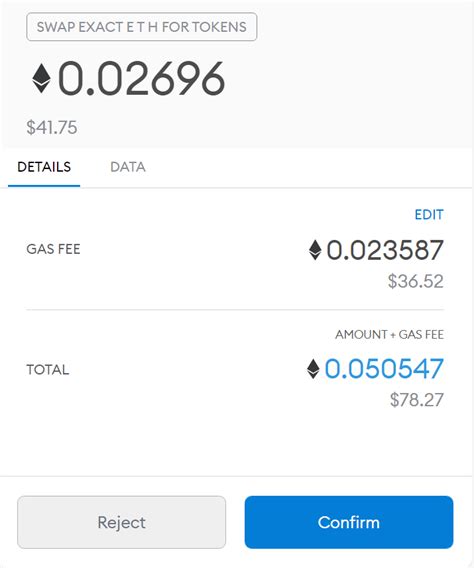

- Failure to be sufficient gas : Ethereum has a strict gas limit (maximum amount of gas available for transactions). If the tokens exchange covers too many large gas values or values, you may not have enough “gas” to end successfully.

- Incorrectly calling the contract

: When the Uniswap universal router is used, you must call an exchange agreement with specific parameters. Inaccurate or missing information can lead to repetitions.

- Balances and amounts of Token : Make sure that all the balances and amounts of Token are precise and comply with the gas values required for the exchange.

Purification steps to solve problems

To solve problems and solve the transactions returned with the Uniswap universal router, follow the following steps:

1. Verify the contract call

- Verify if it causes the correct contract function (

uniswap_v3.reroute) and transfers the required arguments (token amounts).

- Use a gas calculator or a tool like Esterscan to estimate gas requirements for exchange.

Example:

`JavaScript

Const {ethers} = requires ("ethers");

Constiswapv3rauter = new ethers.contract ('0x ...'); // Replace the contract address

// Call the exchange function with correct arguments

To try {

Const tokenamount = [...]; // Start the token quantity board

const gisprice = wait uniswapv3roouter.gasprice ();

Constth = wait uniswapv3roouter.reroute (tokenamount, 0x ...); // Replace the exchange function

} capt (error) {

Console.error (error);

}

2. Verify the balances and amounts of Token

- Verify that all tokens balances are precise and in line with the required gas values.

- Make sure the amount of each token is sufficient.

Example:

JavaScript

Const balancef = wait uniswapv3roouter.getbalance ("token1");

if (balance sheet <100) {// adapt this value to your needs

Throw a new mistake ("there are not enough tokens to change");

}

3. Verify the rights of the contract

- Make sure the Uniswap universal router has the necessary permission to access and use the destination token.

Example:

JavaScript

Const router = new ethers.contract ('0x ...'); // Replace the contract address

if (! router.haspermision (tokenamount)) {

Throw a new error ("insufficient permits");

}

4. Test with a small amount of tokens

- Start by changing two or three tokens to guarantee the success of the transaction.

- Gradually increase the amount of tokens exchanged to observe any problem that arises.

Example:

JavaScript

Const tokenamount = [100, 200, 300];

To try {

// Replace tokens with a Uniswap universal router

} capt (error) {

Console.error (error);

}

`

Application

To effectively replace tokens with a universal uniswap router, it must be necessary in the test and purification process. Following these steps, you can identify and solve problems that can cause subsequent transactions.

Remember::

- Verify the requirements to call the contract and gasoline

- Verify the balance and amounts of Token

- Try a small number of tokens before increasing scope

By using best practices, you can provide reliable and efficient swaps in the Ethereum Network using a universal Uniswap router.