Exploring Low-Tax Countries for Cryptocurrency Gains

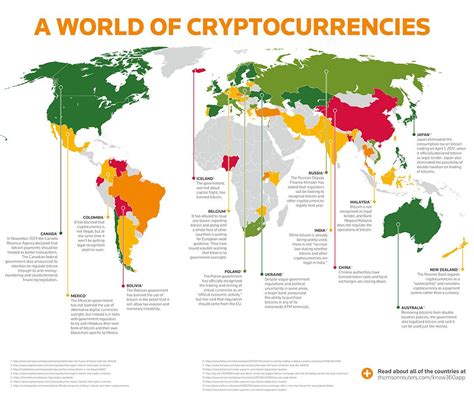

The world of cryptocurrencies has seen a surge in popularity in recent years, with many investors looking to capitalize on this trend. However, while some countries have made efforts to regulate or tax cryptocurrencies, others remain relatively untapped. In this article, we’ll explore several low-tax countries that may be attractive to investors looking to minimize their tax liabilities and potentially maximize returns.

Why Low-Tax Countries?

Low taxes can provide a significant advantage in the cryptocurrency market. Tax authorities around the world are increasingly cracking down on unregulated cryptocurrencies, which can result in higher costs for investors. By moving their assets to countries with lower tax rates or regulatory environments, individuals can minimize their tax liabilities and focus on maximizing returns.

Best Low-Tax Countries for Crypto Investors

Here are some of the best low-tax countries for crypto investors:

- Bahrain: Bahrain has a relatively relaxed approach to cryptocurrencies, with no tax on gains from buying or selling them. The country also offers a 10% tax on dividends and interest income.

- Singapore: Singapore is a financial and technology hub, making it an attractive destination for crypto traders. There is no capital gains tax on income earned overseas, and the government has introduced a range of tax incentives to encourage investment in emerging markets.

- Malaysia: Malaysia has made significant strides in regulating cryptocurrencies, with a 5% tax on profits from buying and selling cryptocurrencies. The country also offers a range of tax breaks for individuals who invest in the cryptocurrency market.

- Panama

: Panama is known for its financial secrecy laws, making it an attractive destination for high-net-worth individuals looking to diversify their portfolios. While there are no specific taxes on cryptocurrencies, investors can declare income from interest and dividends earned abroad without paying tax.

- Bermuda: Bermuda has a well-established banking system and a range of financial regulations that specifically address cryptocurrency investments. There is no capital gains tax on profits from buying and selling cryptocurrencies.

Key Considerations

While these countries offer attractive tax rates, there are other factors to consider when investing in low-tax jurisdictions:

- Regulatory Environment: While regulatory environments can be beneficial, they can also introduce uncertainty or risk for investors.

- Tax Compliance: Investors must always comply with tax laws and regulations, even if they live abroad. This can require complex arrangements and ongoing planning.

- Currency Volatility: Cryptocurrency prices are known to fluctuate rapidly, meaning that investments in low-tax countries can be subject to significant price fluctuations.

Investment Strategy

Given the complexity of investing in cryptocurrencies across multiple jurisdictions, it is essential to develop a well-thought-out investment strategy:

- Diversification: Spread your investments across different asset classes and currencies to minimize risk.

- Tax Planning: Consult with tax advisors or accountants to optimize your tax strategy and ensure compliance with local regulations.

- Currency Hedging: Consider using currency hedging strategies to mitigate the impact of price fluctuations on your investment portfolio.

Conclusion

Investing in low-tax countries for cryptocurrencies can be a lucrative opportunity, but it is essential to approach this market with caution and careful planning. By understanding the key considerations and investment strategy outlined above, you can potentially minimize your tax liabilities and maximize the returns on your cryptocurrency investments.