Navigate unstable waters of cryptocurrency markets: To understand supply and demand, market signs and systemic risk

The cryptocurrency market has been a wild road over the past decade, prices fluctuated wildly, in response to a complex factor. The Cryptocurrency Market is based on supply and demand and continuously developing market signals. Despite the many risks involved, investors and merchants continue to go into space, looking for potential profits in an otherwise volatile environment.

supply and demand: two sides of the coin

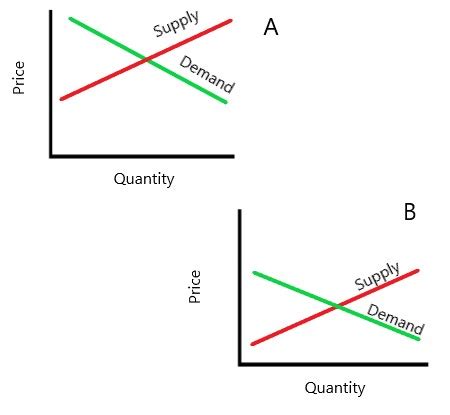

In traditional financial markets, demand and demand are a basic concept that leads price movement. In the cryptocurrency, this concept uses its own life, prices affect the number of coins available for commerce, as opposed to the number of customers.

There are two types of offers:

Market Supply refers to the full range of a particular coin or token, while

offer and

Question Supply applies to available offerings. If there are more offers than the questioning, prices usually rise as investors are willing to pay higher prices to shop for the market. In contrast, if there are more questions than the offer, prices are usually reduced.

In addition

* Mining

Awards: higher mining fees can lead to lower prices and demand for increased coins.

* Liquidity : The amount of coins available on the stock exchange and other markets can affect trading volumes and prices.

* Regulatory Environment : Government regulations and laws regulating the use of cryptocurrencies can influence supply and demand.

Market signs

Cryptocurrency markets are driven by a complex factors, including technical indicators, basic analysis and market emotions. Market signals play a critical role in determining price movements by providing valuable insight into investor attitudes and market expectations.

Some common market signals are as follows:

* Trend lines : The direction of price movement can be indicated by the trend lines of the charts.

* Support and Resistance Levels : These levels are key to identifying areas where prices can bounce or continue to fall.

* Technical indicators : Indicators such as moving averages, RSI (relative strength index) and Bollinger bands provide additional insight into market emotions.

Systematic risk

While individual investor decisions can lead to price movements in the cryptocurrency market, systemic risks are a greater risk to stability and security. These risks include:

* Voatity : Cryptocurrency prices are notoriously volatile, making them vulnerable against sudden and unexpected changes.

* Liquidity Risks : In some markets, lack of liquidity can lead to price fluctuations and increased risk of merchants.

* Regulatory uncertainty : Changes in government regulations and laws regulating the use of cryptocurrencies can affect market stability and security.

Relieve systemic risk

In order to reduce systemic risks, investors and merchants should be aware of the following strategies:

* Diversification : Distribution of investments on multiple devices to reduce risk.

* Risk Management : Set up price targets and set positions as needed.

* Stay of information : Regular inspection of market news, analyzes and technical indicators.

Conclusion

Due to the nature of the cryptocurrency markets, it is complex and dynamic environments that require a deep understanding of supply and demand, market signs and systemic risks. By recognizing these factors and implementing effective risk management strategies, investors and merchants can navigate with greater confidence in the unpredictable waters of the cryptocurrency market.